Electric Avenue

BMW’s Oxford plant looked to have an assured future, building electric Minis for the Net Zero age. Then, this week, all this was thrown into doubt as the German firm paused a planned £600m investment. What went wrong?

Years of blowing hot and cold on the future of Plant Oxford finally looked to be resolved in 2023. That year, BMW Group announced a £600m investment into the Mini assembly plant, upgrading it to produce new electric models from 2026 and be all-electric by 2030.

Now it has paused that investment, citing “multiple uncertainties facing the automotive industry”. Its Oxford employees, and the many suppliers that rely on BMW’s Cowley operation, are understandably nervous. The statement attempted to sound an upbeat note: “Plant Oxford is at the heart of MINI production, manufacturing and exporting models which are sought after in the UK and around the world.” But as petrol and diesel cars face their final years on sale, why should Mini’s electric future be in any doubt at all?

All over the world

We thought this was a good cue to take a look into the global electric car market, and how this filters down to Cowley. We’ll do this with the help of data from ‘our friends electric’, independent research organisation New Automotive, who collect data on 85% of the global car market. Strap in for automotive abbreviation soup!

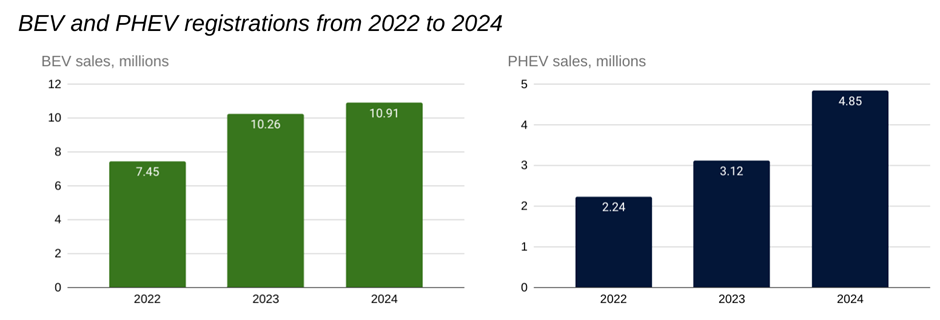

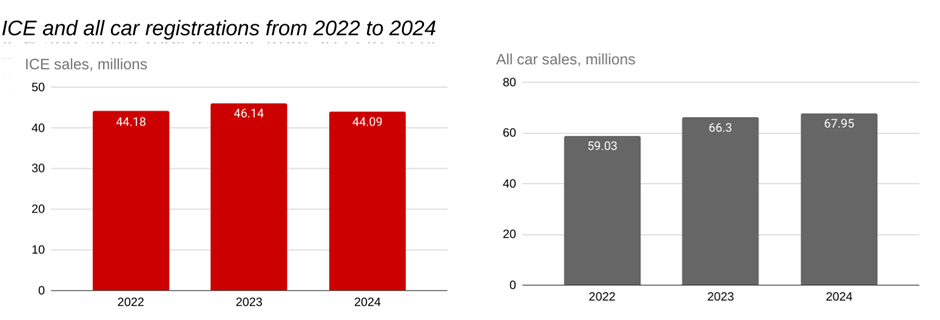

Globally, electric car sales are growing. 2024 was the biggest year yet for ‘pure’ Battery Electric Vehicle (BEV) sales, though the growth rate slowed from 38% in 2023 to 6% in 2024. Plug-in Hybrid Electric Vehicles (PHEVs), where you can charge them or fuel them, have been rising rapidly and are now nearly half the level of pure BEVs.

Meanwhile, Internal Combustion Engine (ICE, i.e. petrol or diesel) sales fell in 2024. The total global car sales market virtually flat-lined, growing only 2.5%. Yes, there’s a missing piece: that is petrol and diesel ‘hybrids’, with a traction battery but without a charging port. But the big news here is that simple combustion engine car sales are now in decline.

Continental drift

Where people are buying EVs matters. Building cars where the buyers are avoids shipping costs, shortens production lead times, and reduces carbon emissions for transporting what is, after all, supposed to be a greener vehicle.

China is the world’s biggest producer and buyer of electric cars by a long way. Sales are nearly 6 times those in the USA. Battery electric sales were up 7% in the year and combustion car sales were down 8%. Taiwan is Asia’s other electric success story; India is all about 2 and 3-wheelers, and most of the cars are petrol and diesel; Japan is surprisingly non-electric, with only 1.35% electric market share.

In the USA, battery electric registrations rose to 8% of the total in 2024, possibly as buyers hurried to take advantage of up to $7500 tax credits provided by the outgoing Biden administration. (These still remain in place, no doubt helping Elon Musk’s Tesla.) Other nations are in the low single digits, typically around 2%.

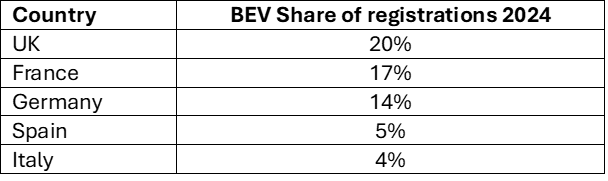

Compared to these, Europe is way ahead with an average of 15% car sales being fully electric across the continent. The leaders and laggards can be clearly linked to government policies. Norway is the clear leader with 85% of new sales being electric: Norway introduced taxes on vehicles based on exhaust emissions (which EVs don’t have) and weight (which they do), exempted electric cars from VAT, half of road taxes and tolls, and reduced parking charges. (Avid Clarion readers may recall an unsuccessful Green motion in the City Council to explore weight and emission based charging for parking.)

Among the big five European economies, the surprise champion is the UK, with 20% of new car sales in 2024 being pure electric. The UK’s market was started by subsidies, but is now driven by the ‘ZEV Mandate’, of which more below. France and Germany have continued with subsidies, but a large withdrawal of subsidies in Germany caused BEV share of sales to drop from 18% in 2023 to 14% in 2024.

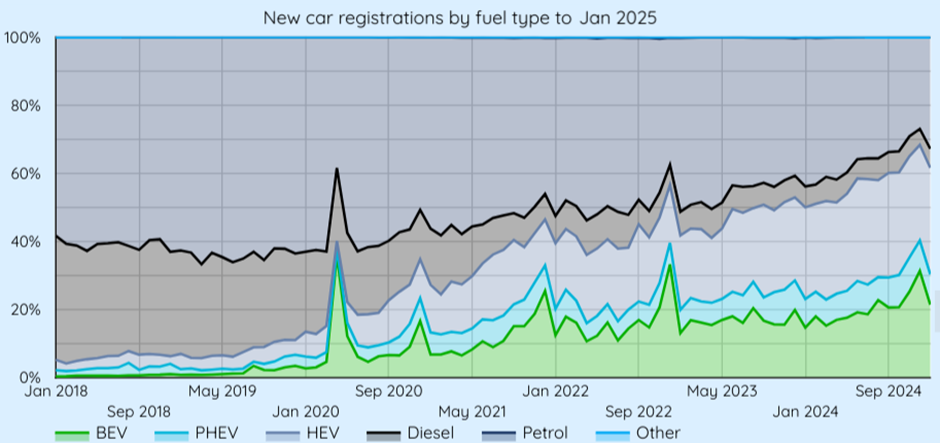

UK electric car sales have been broadly rising albeit with peaks and troughs for years. They eclipsed diesel long ago, and in December, temporarily passed petrol sales. By the trend, they’ll be back. BEV registrations in 2024 were 368,000, 20% of the total, up from 17% in 2023.

The most popular marque for electric cars in the UK in 2024 was Tesla, with 49,600 registrations, all electric. (Whether that will continue given recent global events remains to be seen.) The 2nd most popular, was BMW’s core marque at 32,500, 28% electric (32% in January 2025). Its Mini line was further down the list with 9,500 registrations, 23% electric (jumping to 43% in January).

A twist in the tale

There’s an twist here. The UK’s relatively high share of 20% BEV sales in 2024 has been driven by the ‘Zero Emission Vehicle Mandate’. This Government scheme sets a target percentage for each vehicle manufacturer, with a £15,000 per car penalty for manufacturers that don’t make it. In 2024 the ZEV mandated target was 22%. Has the industry failed to deliver?

It turns out that it is a bit more complicated than that. (And here you can ‘choose your own adventure’. For the full detail, keep reading. Or skip to the last short paragraph of this section.)

Manufacturers have four targets and four trading schemes to consider – the ‘Vehicle Emissions Trading Schemes’. Two are for cars and two are for vans; two regulate the balance of Zero and Non-Zero Emission Vehicles, and two regulate the CO2 emissions of the emitting vehicles (we did promise you detail!). We’ll focus on cars, but the van one is mostly the same.

If manufacturers miss the target for Zero Emission Cars registered each year, they must pay £15,000 per car for the excess. (This is the Car Registration Trading Scheme, or CRTS.) The target goes up each year: 22% in 2024, 28% in 2025, 33% in 2026. By 2030 it will be 80%, and 100% in 2035. So if Clarion Motors produced 100,000 cars in 2024, and just 20,000 were electric, we would miss our target by 2,000 – meaning we would owe 2,000 x £15,000, or £30m. That’s quite an incentive to electrify!

But there are ways around this. You can be small (under 2500 vehicles a year and you can escape the scheme). You can bank credits in one year to use later, or borrow them from the future. You can pool credits within a group, e.g. BMW with Mini, or Volkswagen with Audi. You can buy them from other manufacturers. (Tesla, which only makes electric cars, is bound to have some spare.)

And then there’s another, fiendishly complicated option. The CO2 regulation scheme (Car CO2 Trading Scheme, or CCTS) was designed to stop manufacturers allowing their petrol and diesel cars to get worse during the switch to electric. But it gives them a way to benefit from making them better. Until 2026, if they improve CO2 emissions from their 2021 baseline, they can convert these from CCTS (CO2) to CRTS (cars) at a rate of 167 to 1, based on the average baseline emissions of 167 grams of CO2 per kilometre. (If your head is spinning after these four paragraphs, we boiled it down from the Government’s 92-page explanation.)

So if Clarion Motors improved the emissions of its 80,000 non-electric cars from say 180g/km in 2021 to 135g/km in 2024, it would gain 80,000 x 45 = 360,000 credits in CCTS (CO2), which it can convert (divide by 167) to 2156 credits in CRTS (cars). That gives us 2000 credits to cover our excess non-electric cars, and 156 spare to bank.

In summary, New Automotive estimates that by reducing emissions of non-electric cars, and a few other tricks, the industry needed to hit only 18%, not 22%, zero-emission car sales to reach the mandated target in 2024. It achieved 20%. Well done them. Bonuses all round.

Back to the future

Returning to BMW, we find that in 2024 as a group (including Mini), 26% of their sales have been electric, putting them well ahead of the ZEV mandate requirements. Gold star for BMW. New Automotive estimates that they have over 7000 surplus car credits.

As we’ve shown, missing the ZEV targets in the UK can get very expensive, very quickly. Selling extra Minis would be one way for BMW to meet the target: a £10,000 discount to sell one electric car in 2026 could avoid two £15,000 penalty payments. BMW is either confident that buying credits will be available and cheap, or that it will meet its own electric car mandate targets from its own production.

So why is Plant Oxford under a cloud?

Put simply, EV supply is outpacing demand. More and more manufacturers are competing for a customer base that is not growing as fast as hoped. BMW is no longer competing solely with other legacy manufacturers like Volkswagen/Audi and Mercedes-Benz, but with pure-electric firms like Tesla and China’s BYD to whom the mandates are largely an irrelevance – other than by selling off credits to reduce their own prices.

This could yet be a temporary blip. But for now, BMW sees less stress on its balance sheet by “pausing” the investment in Cowley. Instead, it can build electric Minis for less in China, while throwing its marketing power behind fresher (and more profitable?) premium EVs like the BMW iX1.

If you're in the market for a new car, consider shopping local and buying an electric Mini. They might be made in China for now, but that plant upgrade needs a critical mass of EVs, and local industry starts at home.

New Automotive data is distributed under the Creative Commons Attribution-NonCommercial-ShareAlike 4.0 Licence.